It was with surprise and sadness that we learned of the death of Robin Williams. How could someone who gave so much to everyone else not realise that he was loved in return? The answer of course was that insidious illness, Depression.

It was with surprise and sadness that we learned of the death of Robin Williams. How could someone who gave so much to everyone else not realise that he was loved in return? The answer of course was that insidious illness, Depression.

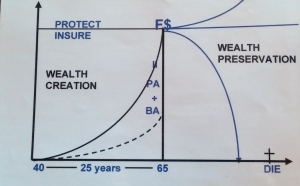

Then I saw this headline in the NZ Herald “Williams was depressed and broke”. It was only a few months earlier that Charlotte Dawson also suffering from depression and ‘jobless and penniless’ ended her life as well. It seems that depression and money problems are a dangerous combination.

I don’t know the details of either’s financial circumstances other than what has been in the media. But both had been in the situation of earning very good incomes during their careers, they enjoyed the good things in life and were able to be generous to their friends and family. Then for whatever reason the money stopped flowing and life became even more difficult when combined with depression. Continue reading